On Tuesday December 12th, 2023, Spoiler Alert hosted a webinar with its customers Kraft Heinz, Campbell Soup Company, and McCormick to share best practices and strategies for managing excess and slow-moving CPG inventory. Ricky Ashenfelter, Spoiler Alert’s CEO & Co-Founder, moderated the discussion with the panelists:

- Chase Carbone | Associate Director, Whitespace & Sales Solutions | Kraft Heinz

- Bryan Miller | Team Leader All Other Value & Specialty | Campbell’s Meals & Beverage

- Brad Murphy | Director, North American Planning & Logistics Analytics | McCormick

.png?width=1200&height=520&name=Email%20-%20Panelists%20(1).png)

To listen to the whole conversation, view the recording here.

Ultimately within the CPG space, no business is actively striving to have a meaningful amount of excess inventory. After all, CPGs are in the business of selling as much product as possible, often to everyday customers, through normal sales, channels and promotional strategies.

An effective discounting strategy is a critical component to minimizing inventory write offs and ultimately preventing further margin erosion from this volume.

Excess inventory goes by a lot of different names and takes a lot of different forms - SLOB, smog, closeouts, markdowns, blowouts, liquidation, at risk, obsolescence - we hear it all.

How do your companies refer to this inventory, and what are maybe the one, two, three top contributors to where excess is happening?

Chase Carbone: We refer to this inventory as liquidation, liquidation sales. Ultimately, at Kraft Heinz our goal is to have inventory in the right place at the right time. So if that doesn't happen as anticipated, which does tend to happen, we're able to leverage this liquidation team, or sales solutions to find a home for it. I would say mainly this falls into two buckets for us: this broad excess inventory bucket or old age.

Brad Murphy: At McCormick, we call this IAR or Inventory at Risk. The biggest drivers are missing forecasts, product innovations, and long supply chains. We have a pretty complex portfolio with many SKUs, making it difficult to forecast it all perfectly. New product launches tend to have overly optimistic forecasts, while items that have a long supply chain have much less margin for error in terms of forecast because we get that set in stone early.

Bryan Miller: At Campbell's, we call our liquidations SMOG, which really stands for slow moving obsolete goods. It's things that are short dated, products that were over demand on inventory compared to what we actually believe we're going to sell, discontinued product, and innovation.

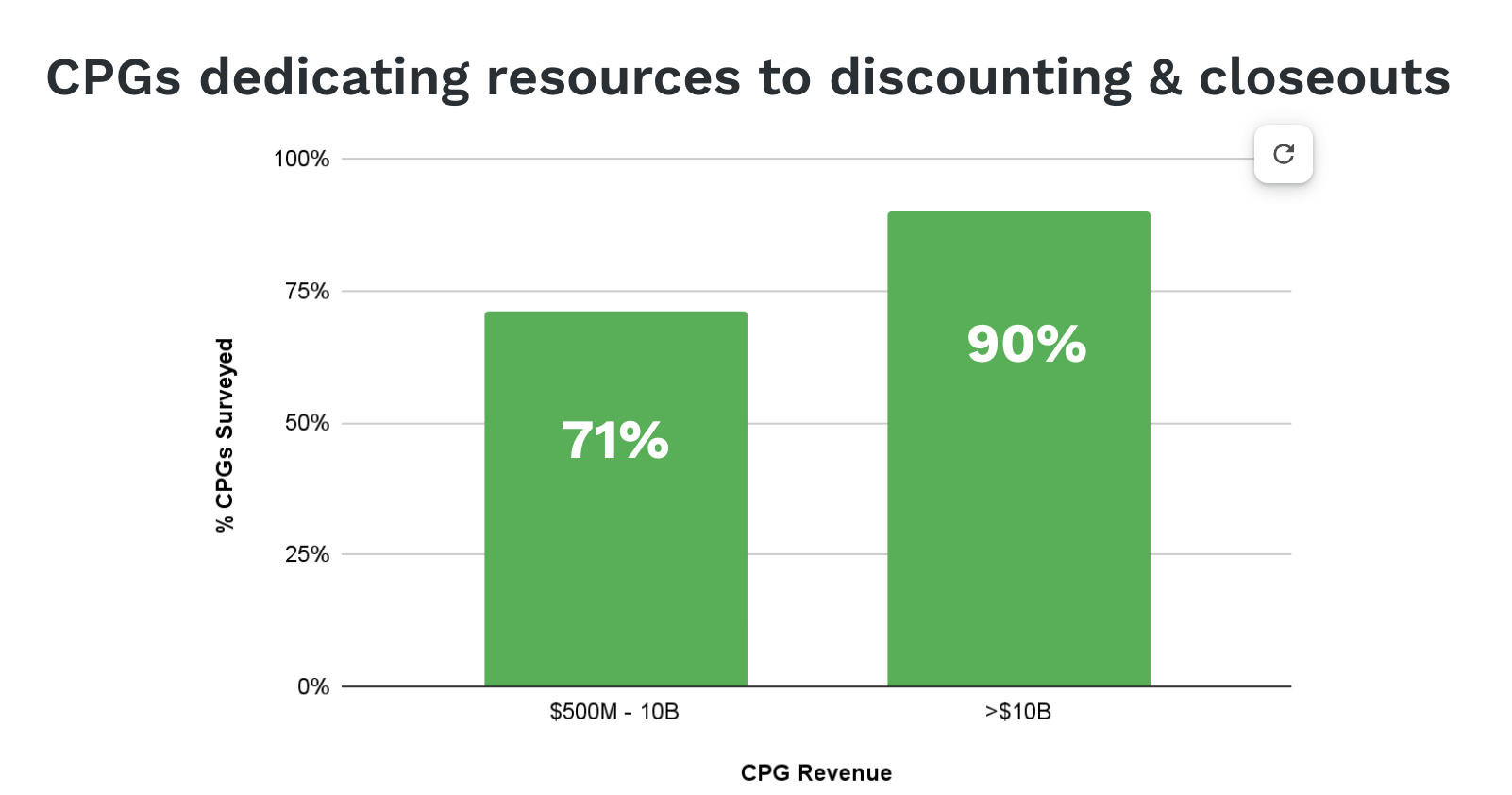

Some people may say “if we're doing our jobs right, there wouldn't be excess, and we shouldn't have to discount.” We surveyed 100 CPGs and found that 90% of the nation's largest brands are in fact dedicating resources to discounting, and that over 70% of smaller brands are also investing in discounting strategies.

So clearly, excess does exist. The companies that aren’t dedicating resources to excess are most likely writing that product off. Brad, is there a perfect demand planning model out there?

Brad Murphy: It would be nice if there was, but, no, I don't think there's a perfect demand planning model. We understand in the supply chain that innovation is risky, but required. More often than not, it's going to fail, but we have to be able to support it. We also have to have ways to get rid of it, right? So if it doesn't succeed, we need to be able to have tools like Spoiler Alert to help us move that product out.

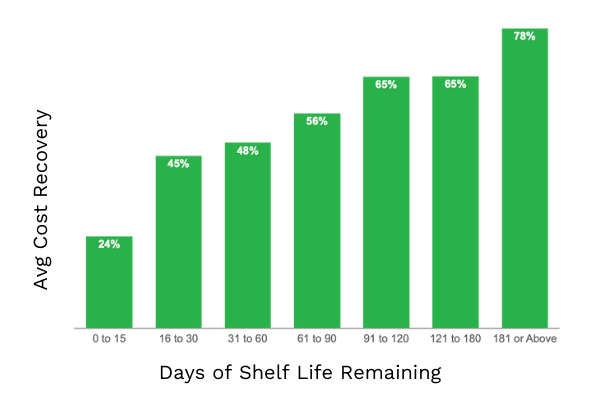

The greater the shelf life of inventory, the higher the cost recovery. The fewer days of remaining shelf life on a product, the lower the willingness to pay as well as the lower the viability, that this product will ultimately find a home. Chase, how does Kraft Heinz think about customer guarantee dates?

Chase Carbone: There is certainly a clock we’re working with that our team keeps a close eye on, especially as there are different shelf lives and customer guarantees across different temperature classes. When we start getting closer to those customer guaranteed dates, then I would say our team has more ability to action that inventory.

It’s widely understood that product innovation is a major source of growth and attention for big brands, but it’s also a reality that most of those SKUs fail. In fact, 85% of CPGs that launch in the US will fail within 2 years. How does Campbell's talk about the balance between innovation and excess?

Bryan Miller: Innovation is very important for Campbell’s. Within our total SMOG availability, probably 25% ends up being innovative products that did work and we have to move through. The fact of the matter is that if you’re not innovating, you’re going to have a challenge growing. A well oiled closeout process helps to mitigate product destruction and waste.

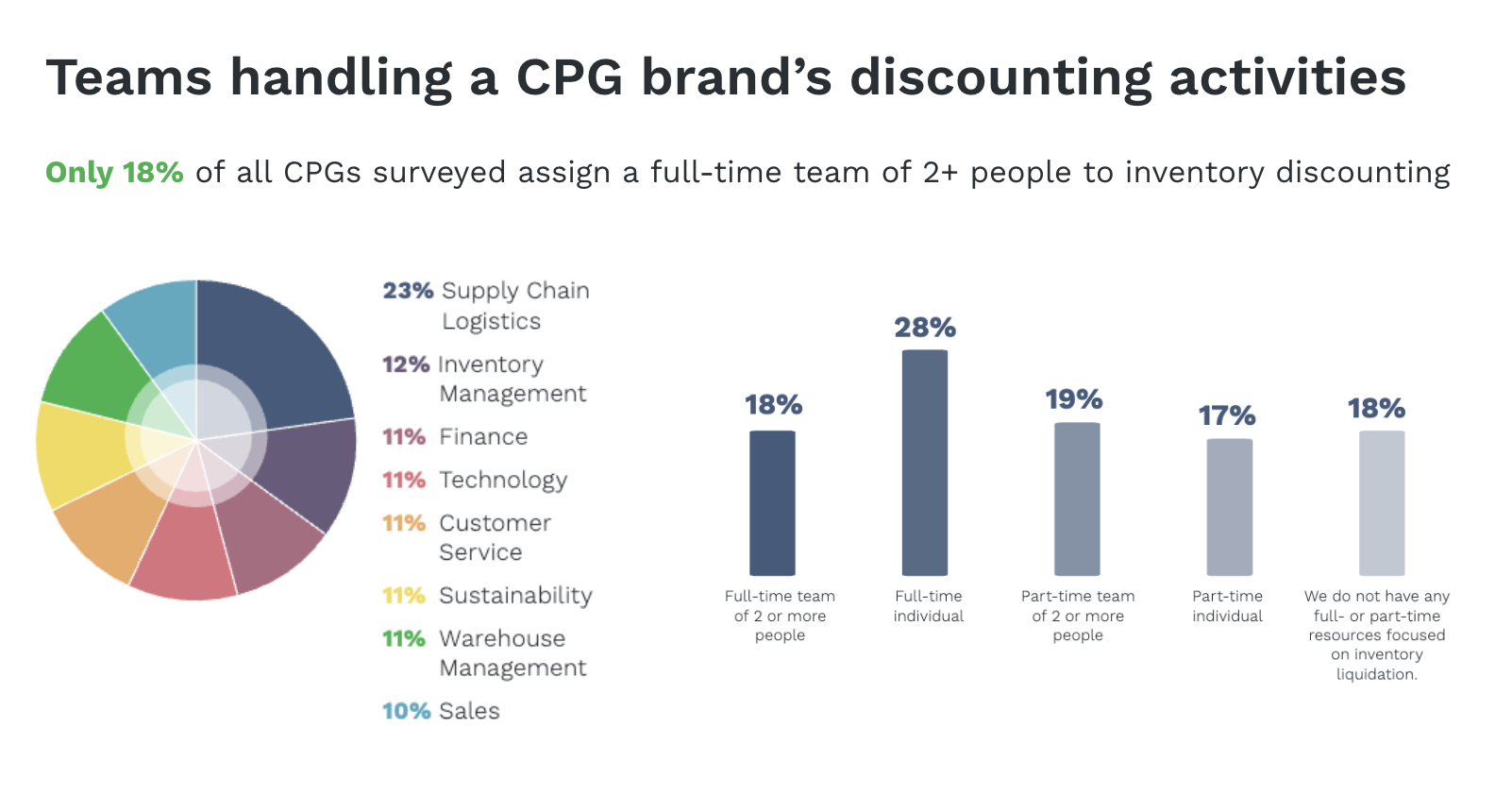

Selling excess inventory is a complicated topic that sits at the intersection of many parts of the business. At Spoiler Alert, we see the teams responsible for this varying from company to company – sometimes in Sales, sometimes in Supply Chain, sometimes in Sales Ops. When surveying other CPG companies, we see a bit more variability and also different numbers of team members resourced against it.

How does McCormick structure its discounting program?

Brad Murphy: My team, the supply chain analytics team, manages the identification of excess inventory based on the forecast of each one of our DCs and the shelf life of the SKUs and the batches. We then take that inventory and share it with our marketing teams to make a call on whether they want to discount or not. What typically ends up happening is that no one wants to accept that we're not selling through this so we’ll see if we can move stuff through discount. Then we take that inventory and include finance to make sure pricing is okay, and then we’ll update that information into Spoiler Alert. Our program is more based on shelf life remaining and the number of cycles that it's gone through on the discount report, to align on a price that we think would work in terms of closing out. We also have a person on the sales side who's dedicated to executing and maintaining relationships with our customers in that space and managing the negotiating process.

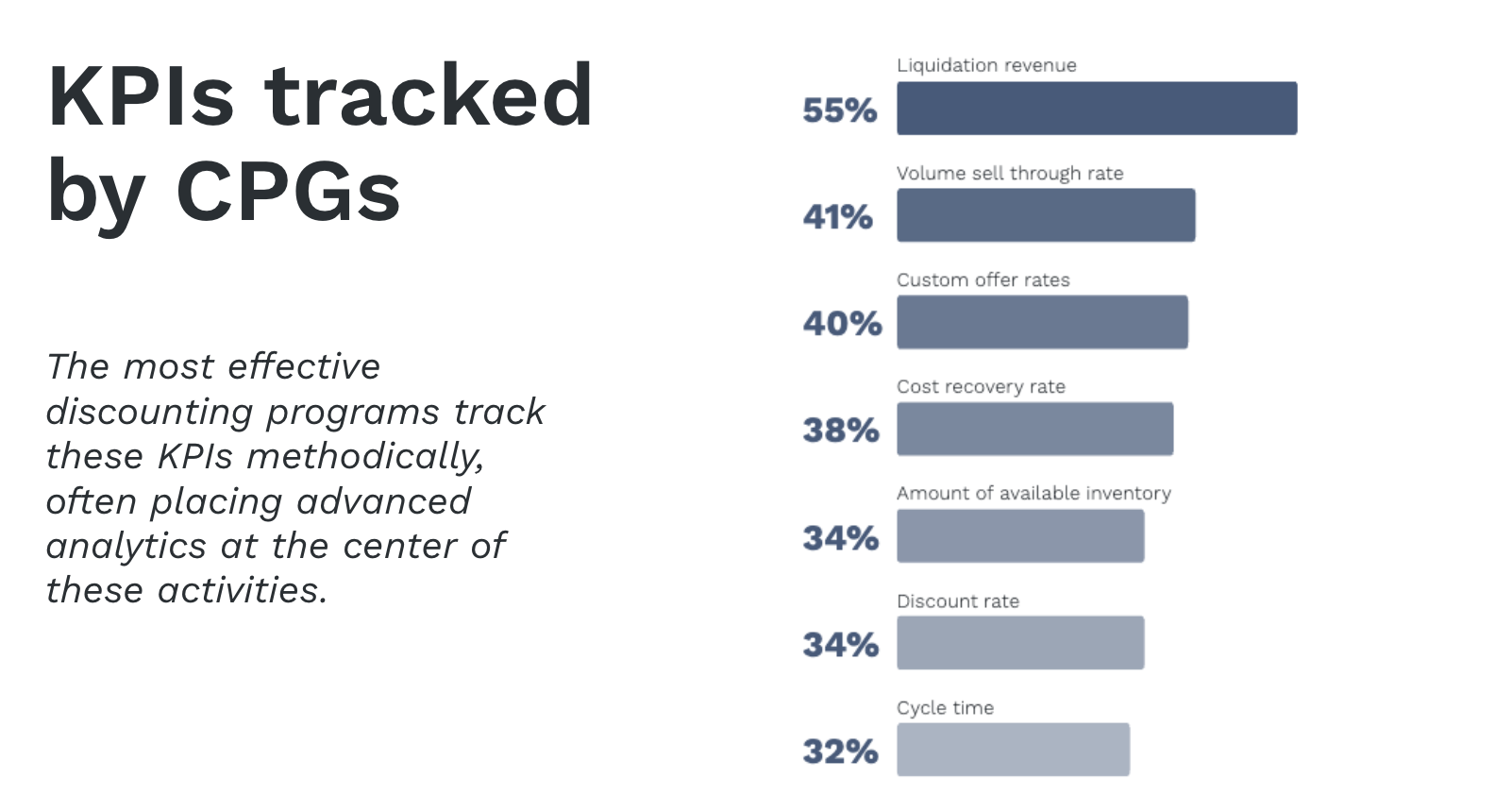

Where a discounting program sits within an organization can often influence the KPIs that matter most to senior leaders. Sometimes that’s price recovery, sometimes that’s volume sold and preventing writeoffs, sometimes that’s fostering goodwill with strategic customers that bridge everyday and opportunistic. What metrics matter most?

Brad Murphy: Minimizing loss overall, or listed cost recovery rates. So trying to get as much as we can from that listed cost of whatever comes through the system. In the past, before we engaged with Spoiler Alert, I think we had someone focused on generating the most value per thing they sold, not necessarily minimizing overall loss. I think we have better analytics now with the Spoiler Alert platform to understand how much we're getting overall from listed cost recovery. I think it's allowed us to minimize loss better.

Chase Carbone: I’d say we do look at all of them. Simply put, our goal in recent years with the partnership with Spoiler Alert was to have a lot more data visibility and to be able to actually understand and look into more of these KPIs.

Let’s talk about cadence. We find more perishable products tend to be listed more frequently, whereas longer shelf life products have less urgency. I believe Campbell’s does its discounting monthly. How’d you land on that cadence?

Bryan Miller: It all goes back to our monthly forecasting process, sales forecasts, supply chain forecast. So it just made logical sense for us to just have it be a monthly process. Our longest shelf life is manufactured at two years, the shortest probably being a year. So supply chain looks at everything first and then it goes into the strategy piece to see what you can sell in traditional markets. Then whatever they can't move, we'll take it and we'll move it. And, you know, it honestly goes really quick.

We see a wide range of approaches to logistics – from pickup to delivery – and where freight costs are or aren’t factored into strategies. Kraft Heinz has probably the most diversified of SKUs – across refrigerated and dry storage. How does Kraft Heinz factor in logistics considerations into where it decides to sell? How does temperature class impact a discounting program?

Chase Carbone: The team does a great job evaluating options, considering factors like product mix and pricing. The decision depends on the situation—sometimes it makes sense to send a truck across the country, other times it doesn't. Spoiler Alert helps with visibility and communication, guiding decisions on a case-by-case basis. Regarding temp classes, the goal is to find the right home for inventory, with prioritization based on shelf life. The overall process is similar across temp classes, but data and insights guide the team in defining the right outlet for the inventory.

Our customers rely on a combination of large national retailers as well as a longer tail of more local/smaller chains or wholesalers in order to keep a diversified buyer network. How much excess inventory a customer has will correlate to the size of their buyer network. If you could boil it down to a few things, what would you say makes for a strong partner on the opportunistic sourcing side?

Bryan Miller: We vet our customers fairly hard. The main thing we look at in a strong partner is, do they have their own outlet to move through the product? The majority of our customers have their own retail outlets and we do have a handful of wholesalers. At the end of the day, we don’t want the inventory making it back to traditional markets.

And Brad, how does your team strike a balance between quantity of buyers and quality of the relationships?

Brad Murphy: Before we had Spoiler Alert, we had three primary partners in this space. They’re still our main customers, but we have expanded a bit based on some of the work the Spoiler Alert team has done to introduce new buyers. We want to make sure that most importantly, we’re limiting loss. So more buyers typically helps that. But you want to balance the fact that you want to keep those buyers happy and give them opportunities at product - to make sure they’re all getting an opportunity to engage with the inventory we have while making sure we’re getting a decent value for it.

It’s been neat to see with Kraft Heinz’s liquidation program how much engagement senior leadership has had with the program. What advice would you give folks that want to get maybe CFOs or CXOs more in touch with their programs?

Chase Carbone: What I'll leave you with is that money talks, right? It's the data and the quantification of attaching a dollar amount to the work that you all are doing - showing the progress, showing the results. Come with clear asks for support and then ensure that you close that feedback loop by sharing the successes or progress when you're able. When we do that, I think that's what drives the most engagement with our leadership at Kraft Heinz.

In the last five years, what notable changes have you observed in the closeout space, and where do you hope the industry will go?

Bryan Miller: In the past five years, the closeout space has evolved significantly. Initially, I used to get random lists ad-hoc from our supply chain team asking “hey, can you sell this?” But with Spoiler Alert's help, organization improved, preventing the risk of selling items twice. Previously, if you didn’t do a good job of updating your Excel sheet, all of the sudden you sold an extra 2,000 cases. So that’s one thing I’ve really loved about, over the last five years, our relationship with Spoiler Alert - helping us get organized and know exactly what we have. I think it's going to continue to evolve and relationships are going to grow, but it's a fun area because you have a lot of unique things that you end up selling on a day in and day out basis.

To listen to the whole conversation, view the recording here.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)