Managing unsold inventory can be a confusing proposition, and it only gets more complicated when you factor in the various terms and definitions that different organizations use. Accurately defining terms and understanding how to manage those different categories is vital for effective collaboration between demand planning, inventory managers and sales leaders.

Back in 2017, we talked about some of the terminology of food inventory. While much of it applies to non-food products as well, there are other hard-to-define terms used with health and beauty care (HBC) products that need outlining. HBC products include personal care, health and wellness, beauty products, and vitamins and supplements.

Baseline definitions

Slow-moving inventory

Slow-moving is a classification for inventory in which the current volume available exceeds sales projections, making it likely to remain partially unsold before its expiration date. For example, if you manufacture 15,000 cases of body lotion that expire in a year, and you’ve only sold 600 cases in the first quarter following production, then you’re probably going to have some issues at the end of the year. Sometimes called excess product, slow-moving inventory primarily occurs due to inaccurate demand planning strategies, which lead to overproduction.

Most manufacturers will establish internal policies for managing this kind of slow-moving product. When the inventory has enough remaining shelf life, sales reps are often allowed to offer discounts to primary retailers in an attempt to boost sales and get the product moving. In other instances, they might start allocating product to secondary sales, donations, or destruction as soon as it’s determined to be at-risk.

Slow-moving inventory is difficult to completely eliminate, but keeping a close pulse on customer demand and market dynamics is typically the most effective way to get a handle on it. Collaboration and communication between the sales and supply chain teams can often identify emerging problems before they cost the business too much.

Obsolete goods

Obsolete goods are items that have undergone packaging or recipe changes, been discontinued, or gone out of season. Seasonal items are the most common obsolete products for many manufacturers. Limited edition products (like soaps, toothbrushes, or tissues that have designs to match the latest superhero movie) and holiday-themed cleaners, fragrances, or accessories are all perfect examples of obsolete goods. Consider an item like peppermint-scented hair conditioner that loses its shelf presence after the winter holidays, making it obsolete even though it may be far from its expiration date.

Similarly, when a company changes branding or packaging design, retailers are often restricted from selling the previous packaging, rendering it obsolete. While the retailer may not be contractually restricted, they may only want the latest and greatest on their shelves to maintain appearances. This kind of issue is becoming increasingly common as manufacturers embrace eco-friendly packaging and alter packaging sizes. In fact, PKG Brand Design predicts that packaging changes will accelerate over the next decade. While these can be great for the environment (and for sales), they can also create spikes in obsolescence.

SKU rationalization is a complex undertaking that eliminates SKUs based on sales volumes (or lack thereof) or the brand’s desire to consolidate manufacturing and marketing dollars towards fewer, more impactful product lines. When SKUs are consolidated and items are discontinued, the remaining inventory will often be diverted into discount sales programs.

Obsolescence is inevitable, but knowing how to get ahead of it, manage it effectively and sell it into the right channels can be the difference between losing millions and breaking even.

Short-dated inventory

Distressed inventory refers to unsold product that is short-dated, but remember that we’re specifically talking about the manufacturer’s definitions here. While consumers may define “short dated” based on the printed expiration date, retailers and manufacturers have commitment dates long before that. Retailers need to be confident that goods coming into their stores have weeks, months, or even years of shelf life remaining so that they have enough time to sell on to end consumers. This minimum lead time is often called the “customer guarantee date”, and serves as a manufacturer’s commitment not to sell products to retailers that fall short of shelf life expectations.

Different retailers have varying requirements when it comes to shelf life remaining, and inventory that exceeds the customer guarantee date is often still far from its expiration date. Thankfully, non-food items like HBC products typically have much longer shelf lives than other categories, especially store perimeter foods, which means longer customer guarantee dates. Still, inventory can be classified as distressed as soon as the number of channels into which it can be sold starts to shrink.

Distressed inventory is common in the CPG industry, in part because CPG manufacturers hold about 50% of all inventory. It’s particularly prevalent in fast-moving CPG industries due to perishability. Clothing might become less desirable as trends change, but it rarely has a firm sell-by date. Plus, many clothing retailers have in-house solutions for distressed inventory: the clearance rack. HBC manufacturers rarely have a similar option, so they need to build more diversified relationships with retailers who are willing to purchase short-dated items at a lower cost and pass some of those savings onto consumers.

It's not always clear

None of this is cut and dry. As you can probably imagine, there can be significant overlap between these categories.

Take sunscreen, for example. If a manufacturer has excess product as Labor Day approaches, how should they classify that inventory? It was likely slow-moving up until that point, and at the end of the summer season it’s going to be obsolete, unless the product has enough shelf life for it to make it to next summer, which it may not. In this case, if a manufacturer doesn’t move it quickly, the customer guarantee date could pass, pushing it into the short-dated category.

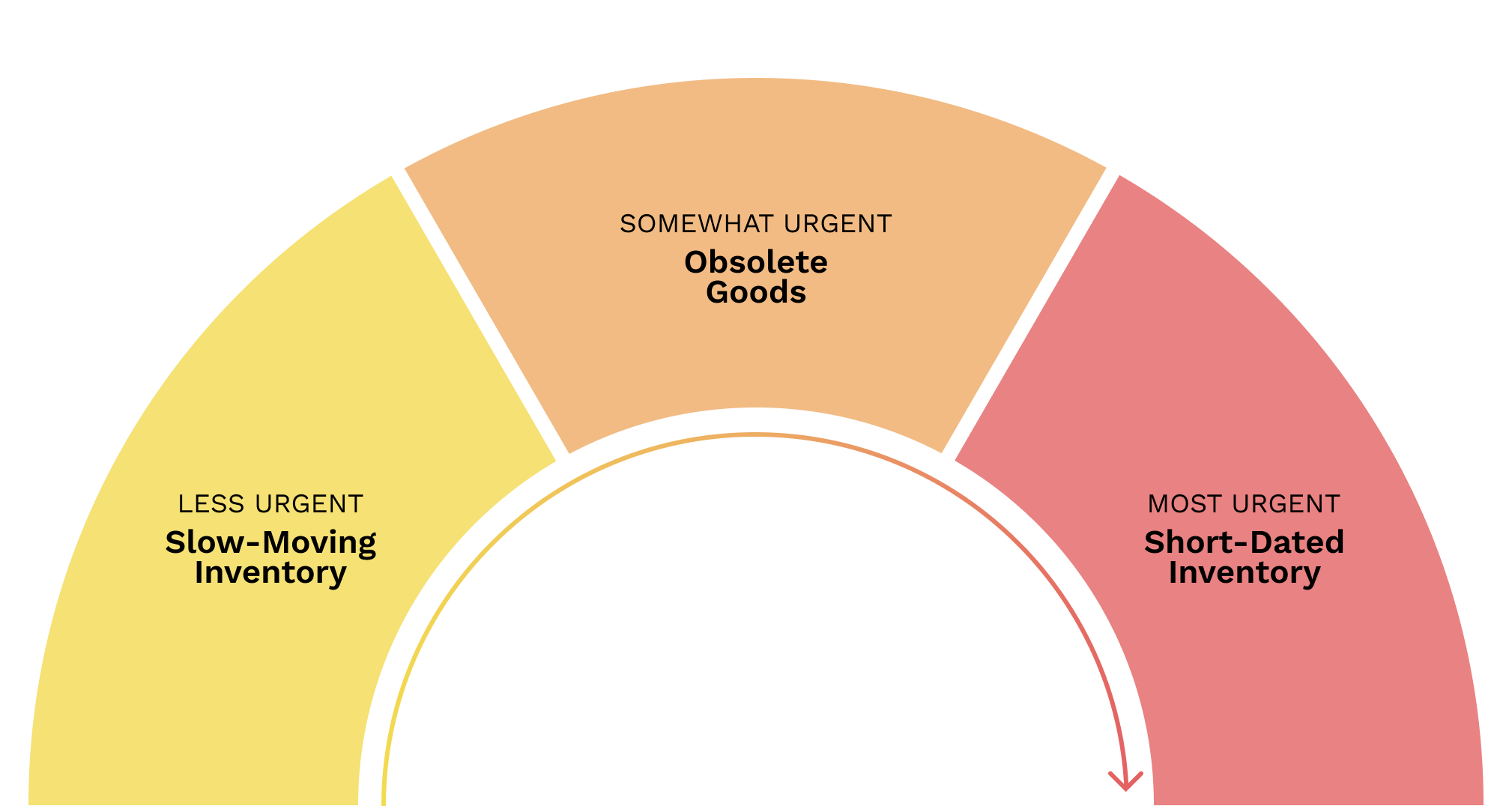

Splitting hairs over which single classification an item falls into isn’t the main point here. Recognizing that all three categories exist, and that they bring various levels of urgency on a sliding scale, is more important.

- Most urgent: short-dated inventory. If you don’t sell it before the customer guarantee date, the number of available sales channels shrinks. If you don’t sell it before the expiration date, chances are good that it’ll end up sent to a composting facility, dumped in a landfill, or combusted for energy recovery. Remaining open to every available sales channel can help ensure that product gets into the hands of consumers.

- Somewhat urgent: obsolete goods. Obsolete goods are far less likely to sell through primary channels. They lose value as they sit in distribution centers in addition to the associated carrying costs, so in the interest of cost recovery, it’s advisable to shift them to secondary channels sooner rather than later.

- Less urgent: slow-moving inventory. If inventory outpaces demand, you’re probably going to end up with excess at the end of the day. From there, you’ll need to source alternative sales channels to free up space in your distribution centers for more profitable inventory. If the product doesn’t have an approaching best-by date, you may want to offer discounts to primary buyers, or brainstorm other incentives to get inventory moving.

When an item is in the gray area between multiple categories, you should play it safe by defaulting to the more urgent classification. This approach allows you to act promptly and minimize losses.

Finding a solution

All three of these categories can put strain on the supply chains and financials of a company. No one wants perfectly good HBC products to end up recycled, composted, or, worst of all, dumped in a landfill.

By better understanding how quickly certain products need to be moved, you’ll know when to take advantage of secondary channels and recover value. Spoiler Alert is the industry-leading platform dedicated to selling unsold CPG inventory into discount channels. With an automated platform, you can increase sales, build more robust relationships with your buyers and recover more value for your organization.

To learn more about the impact Spoiler Alert could have for your company, download our case study with KeHE.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)