While many industries continue to implement digital tools and automation in their supply chain, liquidation processes remain largely outdated and manual process. It’s essential for CPG manufacturers to realize the value of their assets and maximize profitability and minimize losses. However, many companies don’t take full advantage of liquidation programs because they lack the right strategic approach or resources, such as automation tools, to maximize value recovery.

In this blog, we’ll explore key insights from Spoiler Alert’s Technological maturity in the secondary CPG market industry report, which surveyed 100 senior CPG leaders handling liquidations, and how CPG companies can make better use of their excess inventory through methods such as leveraging automation and data.

1. The majority of CPG companies’ liquidation programs are lacking in maturity

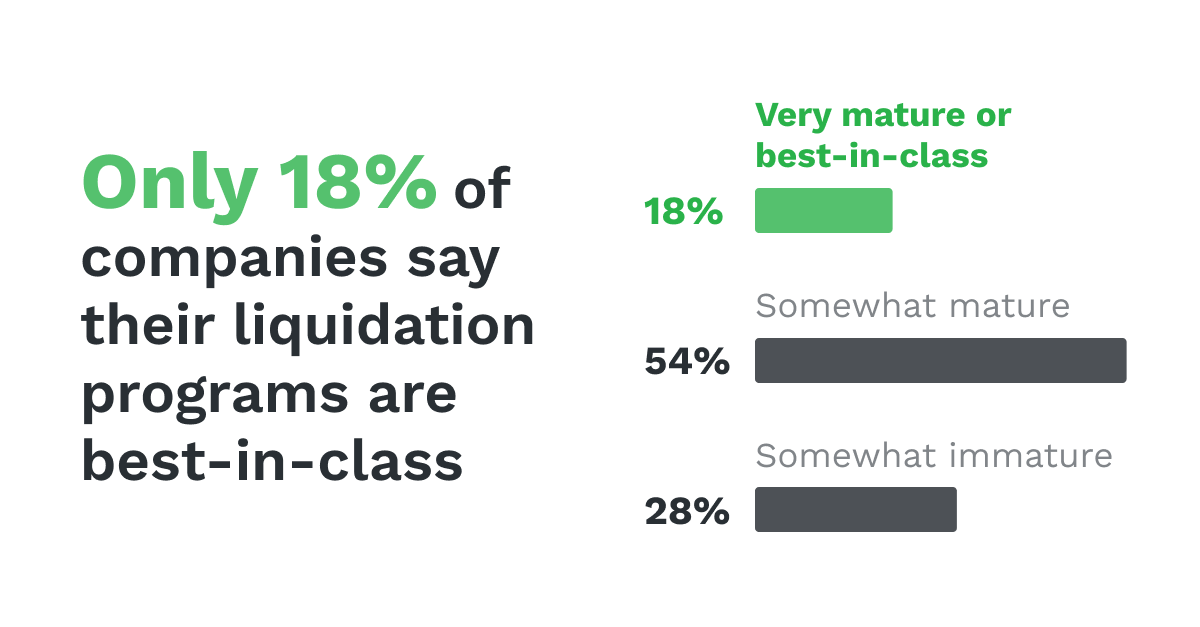

The liquidation industry is still in its infancy, illustrated by the fact that only 18% of CPG companies’ liquidation programs are considered best-in-class. There are a number of barriers that prevent companies from being able to make the most of their liquidation programs, including the lack of automation and technology and outdated, time-consuming processes.

2. Most companies liquidate only once or twice a month

The majority of companies liquidate one time a month (32%), two times a month (31%), in an ad hoc manner, or not at all (23%). That leaves only 14% of companies liquidating on a weekly cadence.

Establishing a regular cadence helps you structure your liquidation process more effectively. After all, liquidating on an inconsistent cadence makes your company appear less predictable and less reliable to your buyers.

So, if your business does not have enough excess inventory to liquidate once a week, make sure that you’re still able to list on a consistent basis. Most buyers are looking for consistency – in timing, pricing, and quality. When they can’t predict when you might have goods available, they’re more likely to source elsewhere.DTC closeout retailers

Closeout retailers don’t have to be just brick-and-mortar stores - in recent years, more e-commerce businesses, such as Misfits Market, deliver excess grocery inventory directly to the customer’s door.

3. Part-time resources manage most liquidation programs

A common reason for low-performing liquidation programs is a lack of commitment and resources to the program. Most companies do not have a dedicated team that can devote all of its time and energy to managing this complex program. In fact, only 18% of all companies surveyed assign a full-time team of two or more people to inventory liquidation.

Additionally, secondary sales tend to be handled as an additional task for sales teams, so it doesn’t get prioritized compared to primary sales, which bring in a higher return on investment.

The process of liquidating is complex and requires input from a variety of teams, ranging from finance and sales to supply chain and procurement teams. Poor coordination can delay sales, harm relationships with buyers, and negatively impact the bottom line. So when you don’t have a dedicated liquidation team to be the central point of contact, an already complex process can become even more difficult.

While it may not make sense to dedicate a full-time individual or team depending on the size of your company, designating at least some responsible parties for liquidation should be a priority.

4. Most companies recover 50% or less of their costs through liquidation

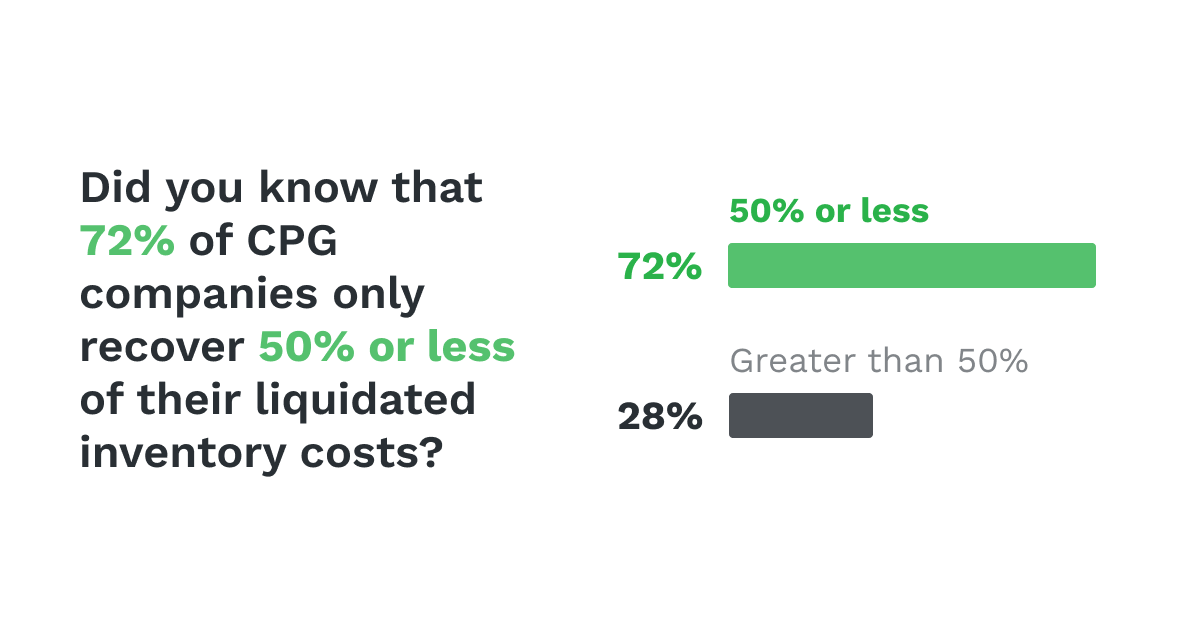

Inefficient and outdated discounting and liquidation processes lead to 72% of CPG companies recovering less than 50% of their liquidated inventory costs.

While it’s understood that secondary sales are less likely to turn a profit when compared to primary sales, it’s important to avoid a complete write-off and reduce financial losses through a robust liquidation process. Simple steps like those listed above – dedicating personnel, sticking to a predictable cadence, and modernizing processes – can help increase cost recovery.

5. The majority of companies liquidate to fewer than 10 buyers

Only 9% of CPG manufacturers have a buyer network that exceeds 10 buyers, while the majority of manufacturers operate with just 4 secondary market buyers or fewer. The report found that this stayed consistent regardless of company size and resources dedicated to liquidation processes.

Liquidation teams struggle to build larger buyer networks for a few reasons. 42% said that they don’t have time to source new channels, and the same number said that buyers are too selective and sometimes unwilling to purchase less desirable products.

6. Few companies link liquidation with their ESG commitments

ESG (environmental, social, and governance) commitments are important for companies to link their values with their supply chain. Companies can use their liquidation program as a way to reduce their carbon footprint by reducing the amount of inventory sent to landfills.

Making your liquidation program more effective is not only beneficial to the environment but also has positive social implications. Discounting inventory and selling it to the secondary market, instead of disposing of it, provides food-insecure and cash-strapped families more access to affordable food and products. Additionally, if you are unable to sell your excess inventory, donating it to non-profit organizations is a more socially responsible option that also allows your company to be eligible for tax incentives.

A lack of awareness, resources, and analytics make it difficult for most CPG manufacturers to link their liquidation processes with their ESG commitments, which is why our report found that only 36% of companies view their liquidation process as a pillar of their waste reduction and ESG commitments.

Companies can benefit from adopting digital tools for their liquidation program

Managing liquidations in today’s climate requires a solution that adds greater efficiency, intelligence, and velocity to liquidation programs to create stronger customer relationships and recover more value from excess inventory.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)