At Spoiler Alert, we focus on waste that happens in the messy middle of the supply chain. Every day we work with brands and manufacturers with excess inventory in their distribution centers, and with the retailers and distributors that purchase opportunistically from them.

We see both sides of the equation – working with both buyers and sellers – so we’ve got a pretty good idea about some of the dirty truths about excess inventory in the CPG industry.

3 dirty truthsThe CPG industry is complicated, maybe more than ever. Between pushes for reshoring efforts and unpredictable supply chain disruptions, manufacturers worldwide are searching for answers. And if you’re dealing with goods that have a limited shelf life, that’s even more urgent.

But a few things hold true, no matter how messy the industry gets.

1. Excess is inevitable

In an ideal world, forecasts are fully accurate and excess inventory is a small – or nonexistent – problem for brands. But we live in the real world, and in the real world excess is inevitable.

If the last year and a half has taught us anything, it's that demand planning is hard. On top of that, products are discontinued, packaging gets updated, and seasons change. Supply chain managers are then faced with short-dated, obsolete and excess inventory.

Of course, when there is excess, the goal is to sell as much of it as possible.

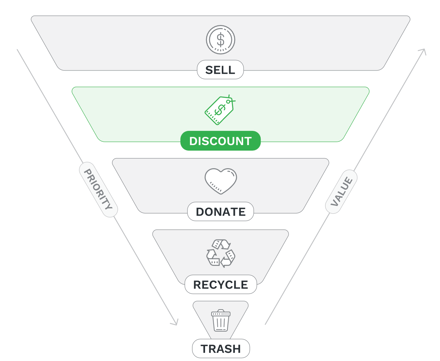

Common strategies for brands include discounts (to primary retail customers or to other outlets), promotions, and liquidation.

When done well, liquidation programs minimize discounts and move excess inventory quickly. That means the companies that acknowledge that excess exists (and will always exist) are best positioned to seize the opportunity in front of them.

2. Liquidation is messy

Moving excess inventory quickly, minimizing discounts and maximizing value recovery are all important goals, but it’s obviously a lot easier said than done. There are many stakeholders across supply chain, finance, sales, and fulfillment. Coordination is difficult.

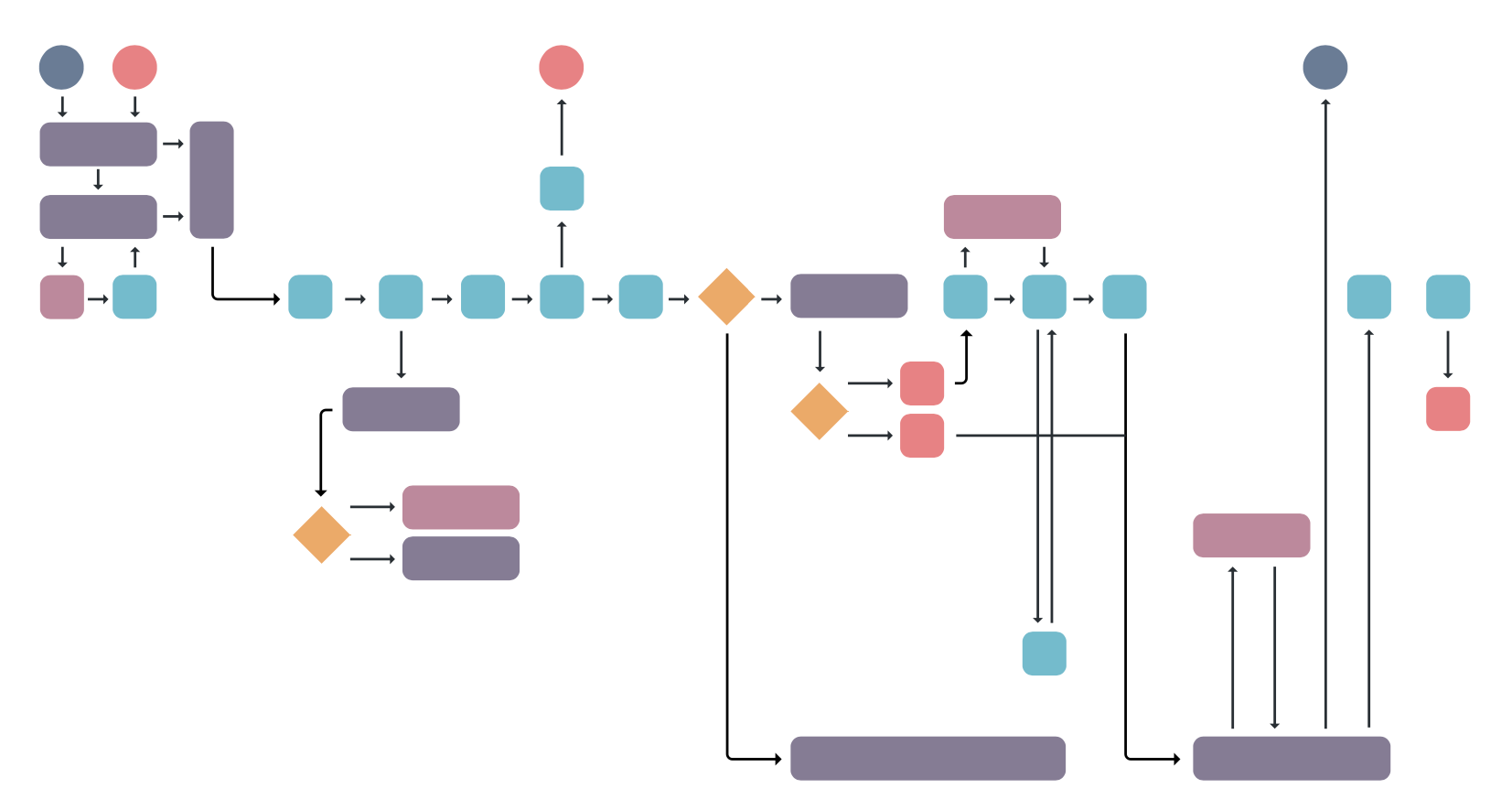

Here’s a simplified diagram of a typical process flow within a leading CPG brand. Yes, simplified.

Legacy systems and manual interventions at multiple steps in the process can often slow down the process of managing excess product. Whether it’s approvals, data exchanges or written communication, it’s almost never a streamlined workflow.

Plus, maximizing value for excess inventory is often not a high priority for sales folks, creating a perfect recipe for problems.

3. slow process = poor results

Slow moving inventory has major consequences. The older the inventory, the harder it is to sell, and the lower the price. This is especially true with perishable CPG inventory, where shelf life is a ticking countdown.

Slow, manual processes in the market today create some pretty shocking industry numbers: on average, brands sell less than half of their excess and distressed inventory. Among the inventory that is sold, it’s usually at steep discounts, well below cost of goods. The average wholesale discount in the CPG industry as a whole is 71% off. Discount programs are routinely leaving money on the table for brands, and providing retailers with inventory that has a shorter shelf life.

On average, only 47% of excess inventory ends up sold, and 30% of excess ends up in landfill. This is the worst possible outcome - for buyers and sellers, as well as for consumers and the planet.

Challenging these truths

The good news is, most of this is avoidable. We don’t have to dump perfectly good product into the garbage. Instead, by empowering your closeout specialist with the right tools, you can provide access to inventory faster and in larger volumes. Plus, you give your retailers faster service and an improved customer experience, strengthening your relationships and increasing the likelihood for long term success.

Get results

Strip out manual steps, from aggregating inventory straight through to order generation. Introduce intelligence where it matters - like pricing and freight intelligence.

With the right tools, you can see a 75% faster speed to market for your excess inventory. By cutting delays throughout the bidding and awarding process, you can sell more product and recover more value. Customers who digitize their workflows with Spoiler Alert have driven more than 50% growth in liquidation revenue and deepened relationships with their buyers. And beyond that, they’ve expanded their buyer channels by 60%.

| 50% | 75% | 60% |

| Growth in liquidation revenue | Faster speed to market | Increase in sales channels |

All of this is possible with Spoiler Alert, the industry’s operating system for B2B liquidation. We offer a set of workflow automation, buyer engagement, and analytics tools that our customers love.

To hear more truths about excess inventory in the CPG industry, and to see how digitizing your process can drive results, download our eBook, 7 Truths About Excess Inventory in CPG.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)