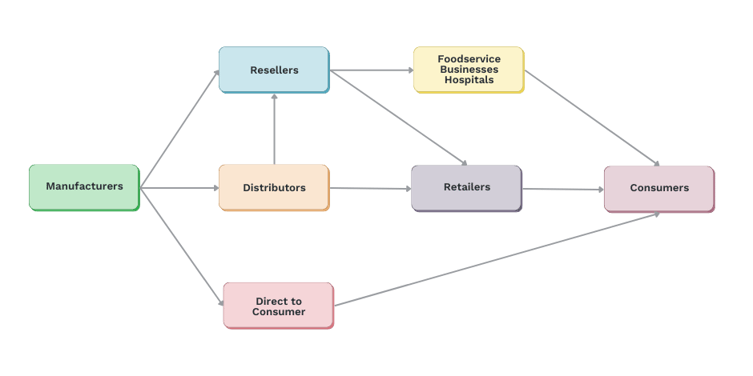

As a manufacturer, understanding the differences between types of buyers in the supply chain and how they operate is critical to developing strategies for reaching each relevant buyer type and getting your product sold.

Each type of buyer has different business models and end goals, so we’ll be reviewing the different types of buyers by their hierarchy in the supply chain:

Distributors

Typically, distributors work closely with manufacturers by acting as an intermediary between the manufacturer of a brand and the next step in the supply chain, like a wholesaler or retailer. Examples of national distributors include companies such as Sysco and US Foods.

Distributors aren’t involved with the manufacturing process itself, but add value to manufacturers by supporting them with multiple services such as warehousing storage (which can include 20,000 to 50,000 SKUs), logistics and transportation solutions, and even helping promote the products to other buyers.

Distributors don’t purchase inventory from one manufacturer - they work with a variety of companies, allowing them to bundle products together and making the process more streamlined. By purchasing large quantities of inventory, they can reduce costs. Working with multiple manufacturers also allows distributors to have a wide variety of product categories available, ranging from food to pet, to health and beauty products.

However, distributors may enter contracts with exclusivity agreements so they’re unable to purchase competing products, unlike wholesalers.

Distributors tend to be more localized than manufacturers and are often responsible for a certain geographic area. This also allows them to build strong relationships with their suppliers and customers and be responsible for handling returns, damaged products, and customer service.

Distributors typically make their revenue as a percentage of revenue stream from the producer or manufacturer.

Because they receive a high volume of product directly from manufacturers, distributors work with reseller representatives or (less often) with retailers. Reseller representatives bring us to the next step in our hierarchy of buyers:

Resellers

Resellers, inclusive of wholesalers, brokers, and traders, will purchase large amounts of inventory and resell products to individual stores, retail chains, or even other resellers, and don’t necessarily always warehouse product, unlike distributors.

One of the biggest benefits of working with resellers is that they often provide excellent payment terms and absorb the risk of selling to many smaller chains that may not have favorable credit. Manufacturers benefit from avoiding this payment risk in addition to avoiding the logistical complexities of dealing with various smaller shipments. And because resellers will handle the sales to many small independent retailers, the manufacturer only needs to move a large amount of product to the reseller and not disrupt normal sales channels.

Another benefit of working with resellers is that they can offer a “take-all” purchase of inventory instead of cherry-picking what works best for them and offer services such as relabeling or repackaging so that your product can be relabeled under a different brand if you’re concerned about brand equity or reputation.

Wholesalers

While distributors have close relationships with manufacturers, wholesalers typically prioritize their relationships with retailers. Wholesalers purchase a high volume and wide variety of products mostly from manufacturers in order to sell to retailers, whether they’re online or in-store. Retailers purchase wholesale inventory in order to save costs by buying in bulk.

When retailers also do not want to warehouse and self-distribute items to their stores, many conventional retailers will work with wholesalers - especially for purchasing small quantities of products, which reduces how much the retailer needs to warehouse.

One of the main differences between wholesalers and distributors is that wholesalers don’t offer many of the solutions for manufacturers that distributors offer, and instead focus on buying and selling product in bulk, or wholesale. Additionally, wholesalers don’t just sell to retailers - they also sell inventory to other organizations such as foodservice companies, businesses, or hospitals.

Wholesalers make a profit through the difference between the price they paid for the bulk product and the price they sold it to retailers.

Similar to distributors, wholesalers will also warehouse product at their locations and help manufacturers get their products sold to end consumers.

Food brokers

Food brokers help manufacturers, particularly of emerging brands, sell their products into retail accounts through their existing relationships with the retailers and through their marketing and communication expertise. Think of food brokers as the sales and marketing arms for manufacturers who don’t have the internal infrastructure to support these activities.

Food brokers often represent many different food items and categories and may occasionally represent competing brands and products.

Food brokers usually do not take possession of product or warehouse inventory. This means that when working with food brokers, manufacturers will still need to look elsewhere for distribution efforts. Food brokers can, however, support logistics and accounting between manufacturers and retailers.

Traders

Traders mostly sell commodity or ingredient-specific items, including meats, produce, and grains. They also purchase inventory that doesn’t meet specific specifications or doesn’t have the specific grade quality that their usual buyers require.

Additionally, the products that they sell are typically not labeled or packaged, offering buyers the opportunity to rebrand or relabel the product.

Retailers

Retailers sell directly to consumers, whether in-store, online, or both, and make a profit by purchasing inventory from wholesalers or distributors that match their target customer needs and by sourcing from a variety of wholesalers/distributors to find competitive pricing. Retailers will also buy directly from manufacturers if they have the volume to support the minimum quantities required.

Once inventory can no longer be accepted by primary retailers due to being short-dated or obsolete, manufacturers can turn to closeout retailers to sell their inventory at a reduced cost.

Additionally, DTC (direct-to-consumer) retailers, which have become more popular in recent years, is another model where manufacturers or brands sell inventory directly to their customers. DTC models tend to have closer relationships with their customers because of this, but don’t have the support of third parties for distribution, fulfillment, and inventory management.

Conclusion

As a manufacturer, it’s important to have tools and software like a vendor management system in place to track your product as it travels throughout the supply chain.

It’s important to evaluate which business model works best for your inventory and be open to exploring multiple types of buyers to offload as much inventory, whether regular or excess, as you can. This can reduce the amount of waste your business creates, therefore bolstering your ESG goals, in addition to recovering costs you’ve spent on creating the excess stock.

To learn more about the supply chain, check out Spoiler Alert's e-Book,

The State of the Food Supply Chain.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)