More and more, modern CPG companies are recognizing the value in optimizing their discounting programs. As a result, they’re beginning to formalize the closeout role that manages sales into secondary markets. We’ve previously written about the importance of codifying that role, but nearly two years later it remains under-resourced at many companies. As a result, many manufacturers only have one person supporting the function, and if that person leaves the role, there’s no one to pick up the pieces.

The scope of turnover

Across the U.S., full-time job turnover is high, especially among younger workers. In fact, employees ages 25 to 34 had an average tenure of only 2.8 years in 2023, according to research by Forbes. On top of that, nearly 38% of employees quit within the first year of employment, meaning that there’s over a one-third chance that your new closeout specialist will depart and need replacement in under a year, especially as turnover in supply chain is 33% higher than it was pre-pandemic.

Among Spoiler Alert customers, we’ve seen similar trends. In fact, 37% of the companies that we partner with have experienced turnover among their primary discount experts in the last 12 months. Of those, half have had those experts turn over more than twice in the past year.

It’s not just our customers, either. In speaking to one major CPG company that manages its closeout program in-house, we hear a similar story. “We've seen a lot of turnover in that space. I think we're on our third closeout sales lead in the two years since I've been here,” he said. “That desk moves fast.” The cause, he indicated, wasn’t due to underperformance or departures. Instead, he found that this was often viewed as a stepping stone role. “They're running about a six to twelve month life cycle; they keep getting themselves promoted and moving into the main third party sales space.”

"37% of the companies that we partner with have experienced turnover among their primary discount experts in the last 12 months."

This is especially worrying in the discounting function given how often the job sits with only one person. When we surveyed one hundred liquidation professionals, we found that only 18% of them assign a full-time team of two or more people to inventory liquidation. Everyone else had just one person – or none – working on discounting. When you don’t have anyone able to step in and fill in them, they become literally irreplaceable.

Now, this isn’t to say that it’s a bad thing. As previously mentioned, many of these vacancies are caused by team members getting promoted into more senior roles, and that’s something worth celebrating. By no means do we want to prevent that, but we do want to make sure companies are well prepared to manage such transitions as seamlessly as possible.

The costs of heavy turnover

The average cost of replacing an employee, according to Forbes, is about 33% of their annual salary. But with a little bit of digging, it quickly becomes clear that closeout specialists are far more costly than average to replace.

We previously outlined the cost of having no backup plan when your closeout specialist is out sick or takes a vacation. Here, we’ll break down what happens if you have to backfill the role.

Missed revenue

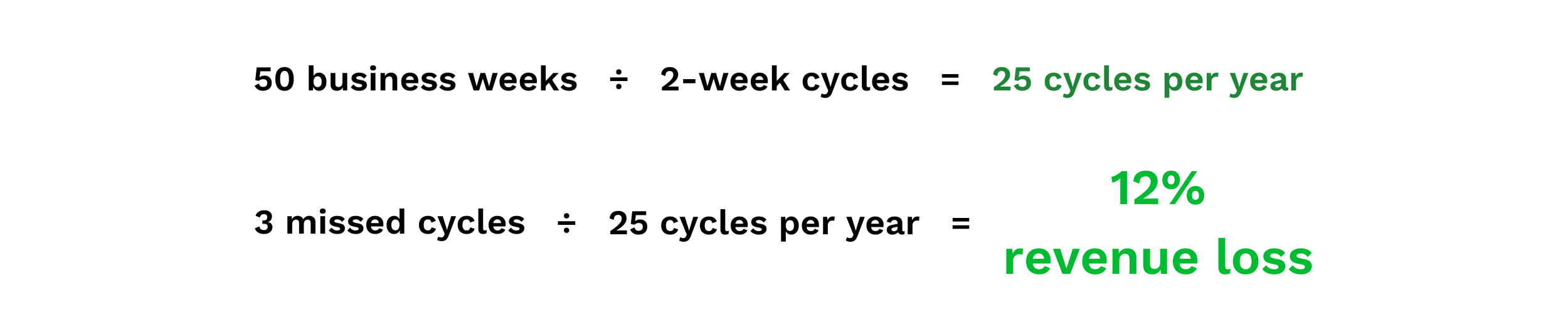

Let’s say you have a single full-time employee managing your discounting program, and they either get promoted or decide to move on from the company. You’re left with big shoes to fill. According to recruiting solution company Emissary, the average time to hire for a full-time role in 2023 is up to 43 days. Assuming your company is running discount cycles every two weeks, that means you’ll miss three full cycles while trying to backfill the role.

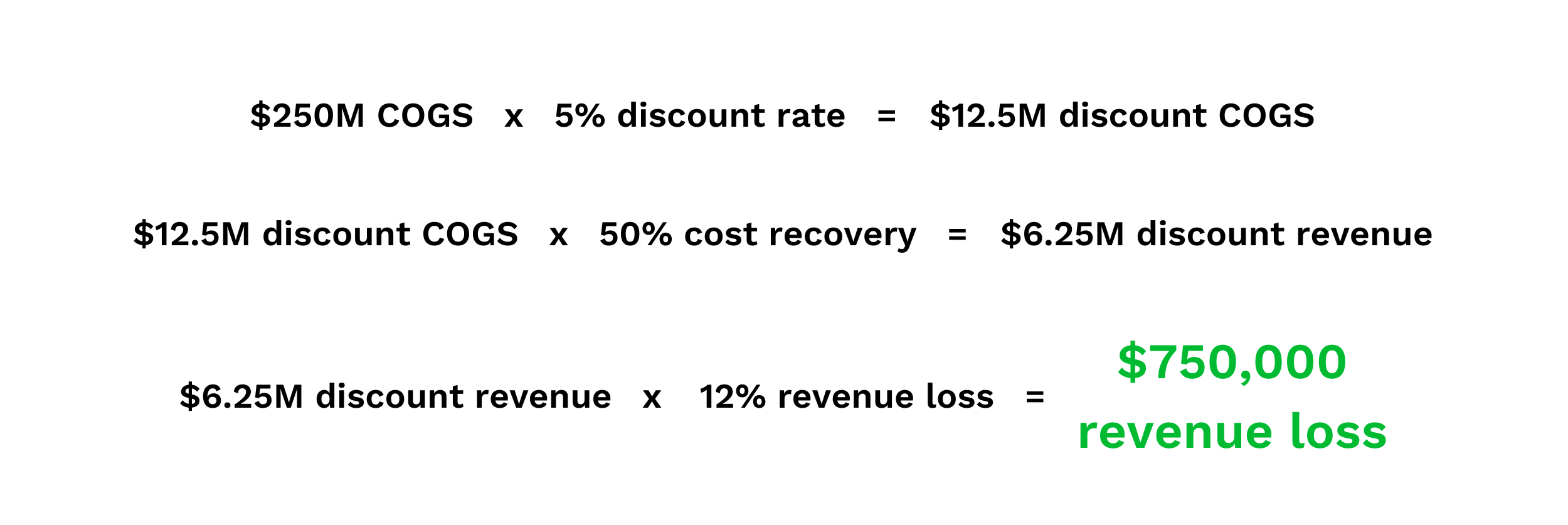

Like we did in our previous post, let’s look at the example of a company with $250 million in cost of goods (COGS), who sells 95% of inventory to primary customers and discounts the remaining 5%. Assuming a 50% cost recovery, the company is generating about $6.25 million in discount sales. If they’re missing 12% of that revenue while trying to backfill the role, that means they’re missing out on $750,000.

Moreover, this calculation doesn’t account for potential missed or underperforming cycles as the replacement onboards, which could inflate the costs by another 50%.

Easing the transition

We previously wrote about how technology can be helpful during employee transitions, including resignations and layoffs. This essentially breaks down into three areas:

- Single source of truth: Having one central source for things like buyer contact information, pricing history, written agreements, and freight information means that a new member of the team can step in quickly. At first that might mean another sales expert filling in temporarily, and then later it would be a full-time replacement. When everything is effectively documented, rather than institutional knowledge living with just one person, it makes transitions much simpler.

- Continuity of processes: Keeping processes consistent, including listing methods and cycle cadences, means your buyers continually know what to expect. That makes the process much easier for them, and maintains the healthy buyer relationships that your previous closeout expert worked so hard to build.

- Modern tools for the modern employee: According to Forbes, employees are three times more likely to explore new career opportunities if they don’t feel supported in their current role. Tooling, and especially modern digital platforms, can play a large role in that. In fact, according to Harvard Business Review, 85% of workers cited collaboration tools as one of the most critical areas of focus for their companies. This is more and more important in the remote work era, where having the agility to connect to tools from home or the office is essential.

Remember the CPG manager who said the liquidations desk turns over frequently? He seemed to recognize the importance of digitizing the process; “It sounds to me like codifying that process and making it sustainable generationally might have value to us as well.”

To benchmark where your organization stands with digitalization, download our industry survey, Technological maturity in the secondary CPG market.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)