Find information below about managing your seconds and organic waste, gleaning programs, using excess food as animal feed, and tax deductions for food donations.

Food Waste on Farms

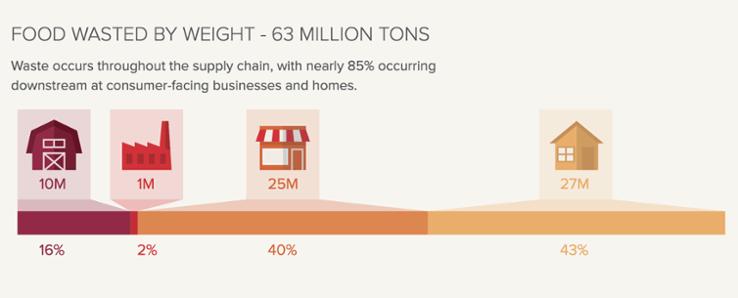

Source: ReFED

Of the 63 million tons of food that is wasted in the U.S. every year, 16% of waste occurs on the farm. This can be due to unpredictable market demand, cosmetically flawed produce, or lack of harvesting resources. Managing the inevitable seconds, surplus product, ugly produce, and food scraps is a reality for most farmers, but a lack of information about where to start can make the process seem overwhelming.

Farm to Food Bank Bills

Many states have Farm to Food Bank programs in place, which give farmers an opportunity to sell or donate their excess. Additionally, Farm to Food Bank bills, such as the New York legislation recently highlighted in the news, could allow “farmers to claim up to $5,000 annually through a refundable tax credit equal to 25% of the wholesale value of their donations to emergency food programs.” The Farm to Food bank legislation would supplement existing legislation about federal tax deductions for food donations that was passed in December 2015.

Farming Resources to Minimize Food Waste

Below are 4 resources to help you manage your seconds and organic waste.

Leftovers for Livestock: A Legal Guide for Using Excess Food as Animal Feed

The Harvard Food Law and Policy Clinic and the Food Recovery Project at the University of Arkansas released "Leftovers for Livestock: A Legal Guide for Using Excess Food as Animal Feed" in August 2016, which includes a list of different state regulations and requirements for feeding food scraps to animals. “Leftovers for Livestock” also explores the practice of feeding food scraps to animals, and offers useful suggestions for both generators of food scraps and animal feeding operations.

A Farmer’s Guide to the Enhanced Federal Tax Deduction for Food Donation

In December 2015, Congress passed a permanent extension of enhanced tax deductions for food donations. With the change, all for-profit farms can benefit from enhanced tax deductions. The NRDC’s resource "A Farmer’s Guide to the Enhanced Federal Tax Deduction for Food Donation" explains how the tax deduction works and gives examples for how to calculate your deductions.

Guide to the Online Gleaning Resources Hub

The National Gleaning Project, in collaboration with The Center for Agriculture and Food Systems at the Vermont Law School, created a "Guide to the Online Gleaning Resources Hub", which includes state laws & regulations surrounding food recovery and gleaning efforts, as well as food reclamation organizations, grouped by region.

List of Gleaning Organizations

Another resource from The National Gleaning Project is this free map tool, which shows food banks, food recovery organizations, and gleaning networks nationwide. You can filter by organization type or state to find nearby outlets for your surplus produce.

To make harvesting donations more economically feasible for farmers, many food banks and food rescue organizations can assist with the “pick and pack out” (PPO) cost. The PPO cost paid to the farmer can oftentimes be equal to or more than the amount they would have received for selling their surplus in a secondary market.

For more information about PPO costs, farm-to-food-bank programs, and managing seconds, check out this article in Civil Eats: Getting Ugly Produce onto Hungry People's Plates.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)