.png?width=1024&name=Blog%20-%20Rectangles%20(1).png)

Liquidation - or the act of selling inventory into the secondary market at a discounted price - is a common practice for managing excess and distressed inventory in the food & beverage industry. When it comes to an effective liquidation process, cadence and timing can be everything. And in an earlier post, we hit this home by breaking down the three most common liquidation cadences.

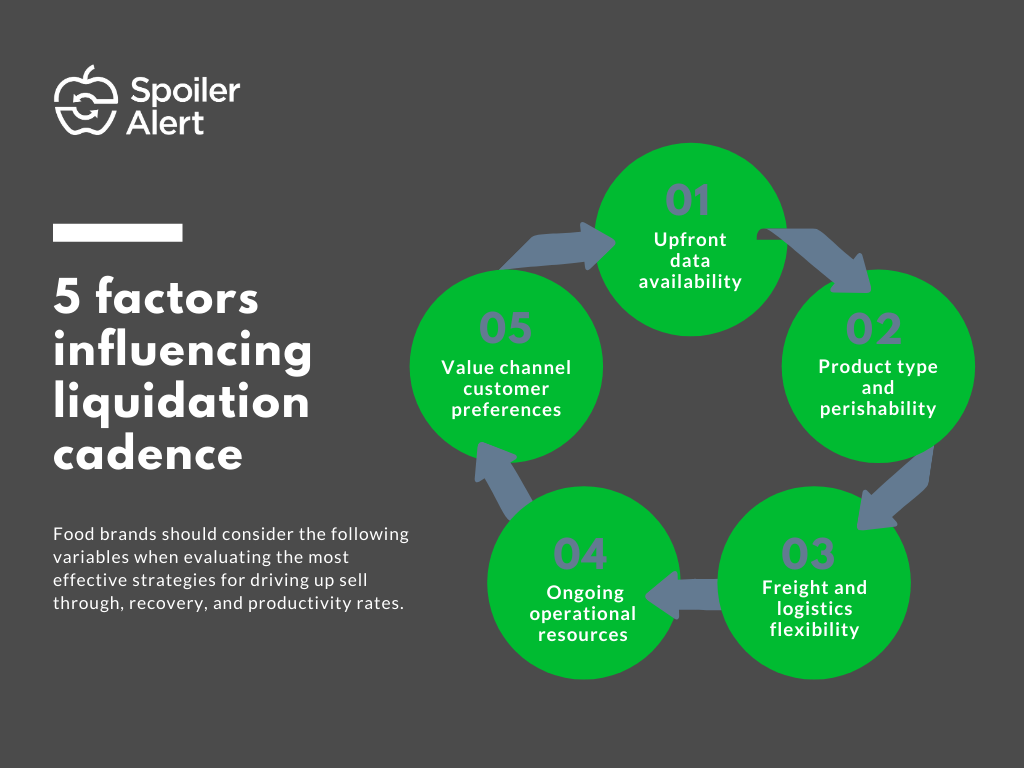

In this post, we look at 5 key factors that CPG brands should consider when assessing what cadence will work best for them in driving up sell through, recovery, and productivity rates. These variables include upfront data availability, product type and perishability, freight and logistics flexibility, operational resources, and customer preferences. Not all companies are created equally, so not all liquidation workflows are going to work out the same way from company to company. Here’s why.

Upfront data availability

As an extension of a company’s Sales and Operations Processes (S&OP), liquidation sales programs typically begin with Supply Chain and Sales teams identifying a consolidated view of surplus, short-coded, discontinued and/or slow-moving inventory. Depending on how advanced and integrated a company’s enterprise resource planning (ERP), demand forecasting and warehouse management systems (WMS) are, inventory data availability can range from A) a single integrated and centralized source to B) many disparate sources requiring heavy manual lifts to get it in a usable format.

Where does your company stand? Are distressed inventory lists able to be generated and refreshed on a regular basis? Do these reports pull from all processing plants or distribution centers? Do they include product information like expiration dates and reason codes, as well as discontinued items and slow-movers? The answers to these questions can influence whether your company is positioned for more rapid and regular liquidation processes.

Product type and perishability

The type of products a company produces or distributes can greatly influence the urgency with which inventory should be liquidated. Perhaps unsurprisingly, the more perishable a product catalog is, the more rapid a liquidation cadence will need to be. Fresh and refrigerated categories (that generally have 20-30 days of shelf life or less) should be liquidated continuously, whereas center of store or shelf stable categories (that generally have 90 days of shelf life or more) have more flexibility.

Freight and logistics flexibility

Often even more important than perishability are the variables that influence freight and logistics, including volume, distance, and refrigeration requirements.

Many of the country’s largest secondary market channels are looking for full truckloads (FTL) for opportunistic purchasing, especially when the distance between origin and destination is significant and the unit economics of shipping costs need to be taken into consideration. Large brands often do not have issues meeting these volume thresholds (whereby roughly 35,000 to 45,000 pounds of shippable product is a good barometer). If FTLs are achievable, then a continuous liquidation cadence makes sense. Smaller brands that can’t meet these thresholds on any given day or week will often opt to accumulate excess inventory till a more meaningful amount of volume builds up (thus opting for a monthly liquidation cadence). While this can be effective for overcoming freight constraints, it does have the effect of potentially shortening the window for which aging inventory can move, along with the cost recovery that can be achieved.

There are two ways to overcome FTL constraints if the desire is to achieve a more rapid liquidation cadence. The first is to allow for customer pickups (CPU) at your facility. This shifts the burden and cost of logistics onto the buyer, which may have more flexibility with coordinating freight than your company can offer. The other option is to offer less than truckload (LTL) options to a more “local” network of liquidation channels. Freight can become more affordable for smaller shipments when the distance is minimized (such as within your metro area or a certain mile radius).

Operational resources

The next consideration for assessing a move to a more rapid liquidation cadence is determining whether your company is resourced appropriately to support it. Liquidation is a team sport and requires cross-functional collaboration between Supply Chain, Sales, and Fulfillment. Cadence and speed can often be hampered by a single node or bottleneck, despite the desirability to move faster and sell through more volumes.

Does Sales have full-time resources available for discounted sales, or is it part-time and on the back burner? Can Supply Chain spin up daily or weekly views into distressed inventory, or do IT constraints and/or demand planning schedules mean that data are only available on a monthly basis? Is there enough dock space or lanes available to support weekly distributions and/or customer pickups, or does liquidation take a back seat to fulfillment constraints that prioritize primary sales and distribution only?

Customer preferences

The last (and certainly not least) factor we will highlight is the interests of your customers. Oftentimes these value channel partners have their own preferences and constraints that influence their ability to accommodate one cadence over another.

For example, what does your customers’ warehouse capacity look like, and how does that subsequently impact the speed with which they can distribute inventory to their customers? What do their demand and replenishment forecasts look like, and how does point of sale (POS) data influence their optimal purchasing cadence?

--

Unfamiliar with how these factors play out at your company? You’re not alone. Shoot us a note and we’ll give you some tips and tricks for process mapping and assessing an optimal approach given the circumstances.

.png?width=250&name=SpoilerAlert_WhiteLogo_LeftStacked%20(7).png)